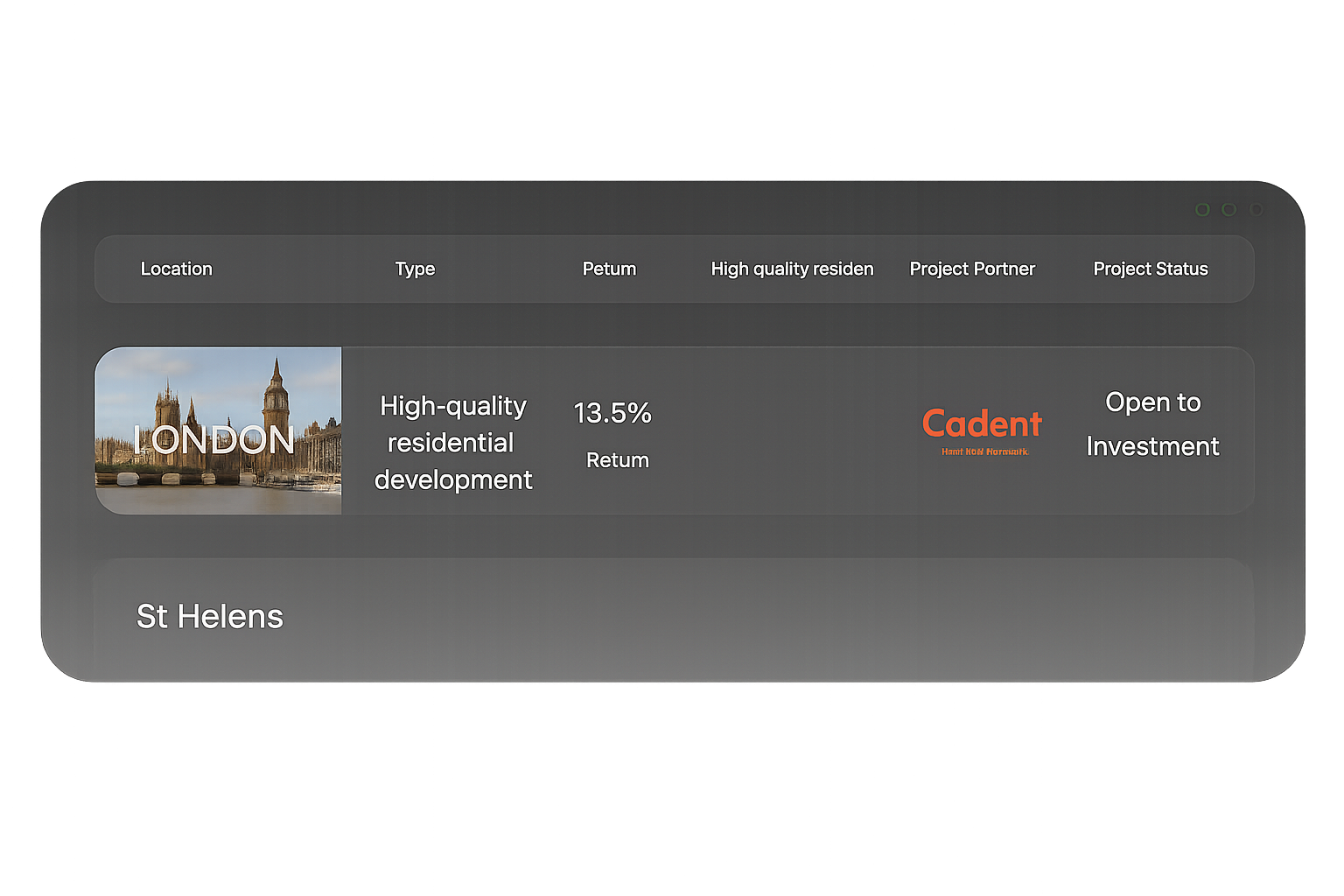

High-Yielding Investment Opportunities

Invest in Prime UK

Developments

Fixed Returns of up to 14% per annum*

Invest from £25,000

Paid out after 12 or 24 months

Managed for you by industry experts

*Returns are not guaranteed. As with all investments your capital is at risk. Please ensure you read the Risk Warnings , before investing.

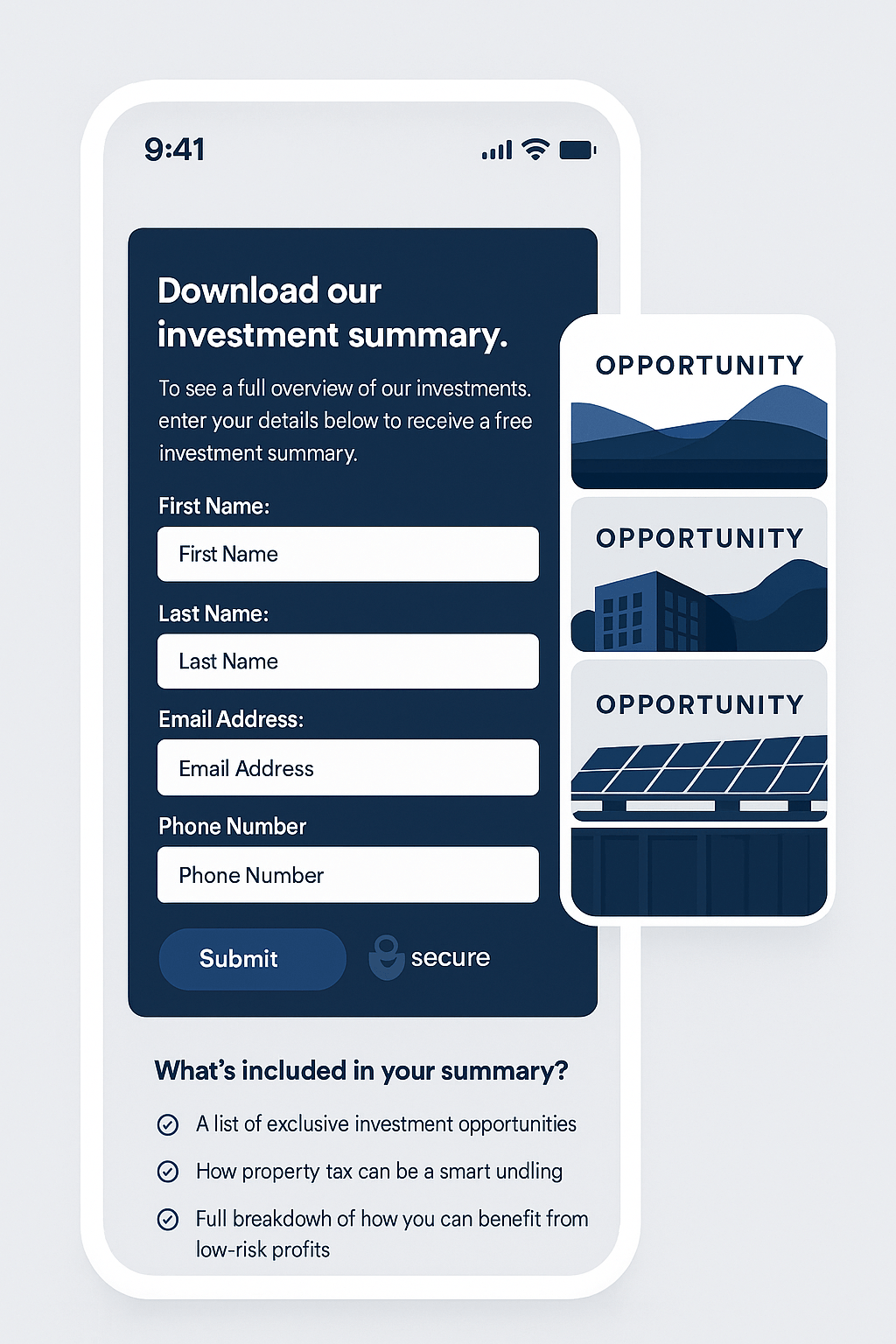

Download our 2025 Investment Summary to unlock available and upcoming investments.

Download 2025 Investment Summary

To see a full overview of investment options, enter your details below to unlock your free investment summary.

By submitting this form you agree to be contacted about investment opportunities by one of our partners and agree to our privacy policy.

If you have any questions, please book a call with one of our advisors.

Currently onlineWe are committed to transparency, ethical conduct, and investor protection. Investing with us means peace of mind, backed by the highest industry standards.

Recognised by:

Recognised by:

Why invest in UK property?

Steady Demand

Urbanisation, population growth, and housing shortages ensure strong, ongoing need for property across major cities worldwide.

Asset Security

Investments are secured against physical properties, providing a tangible hedge against market volatility.

Inflation Hedge

Real estate values and rental income often rise with inflation, helping preserve your buying power.

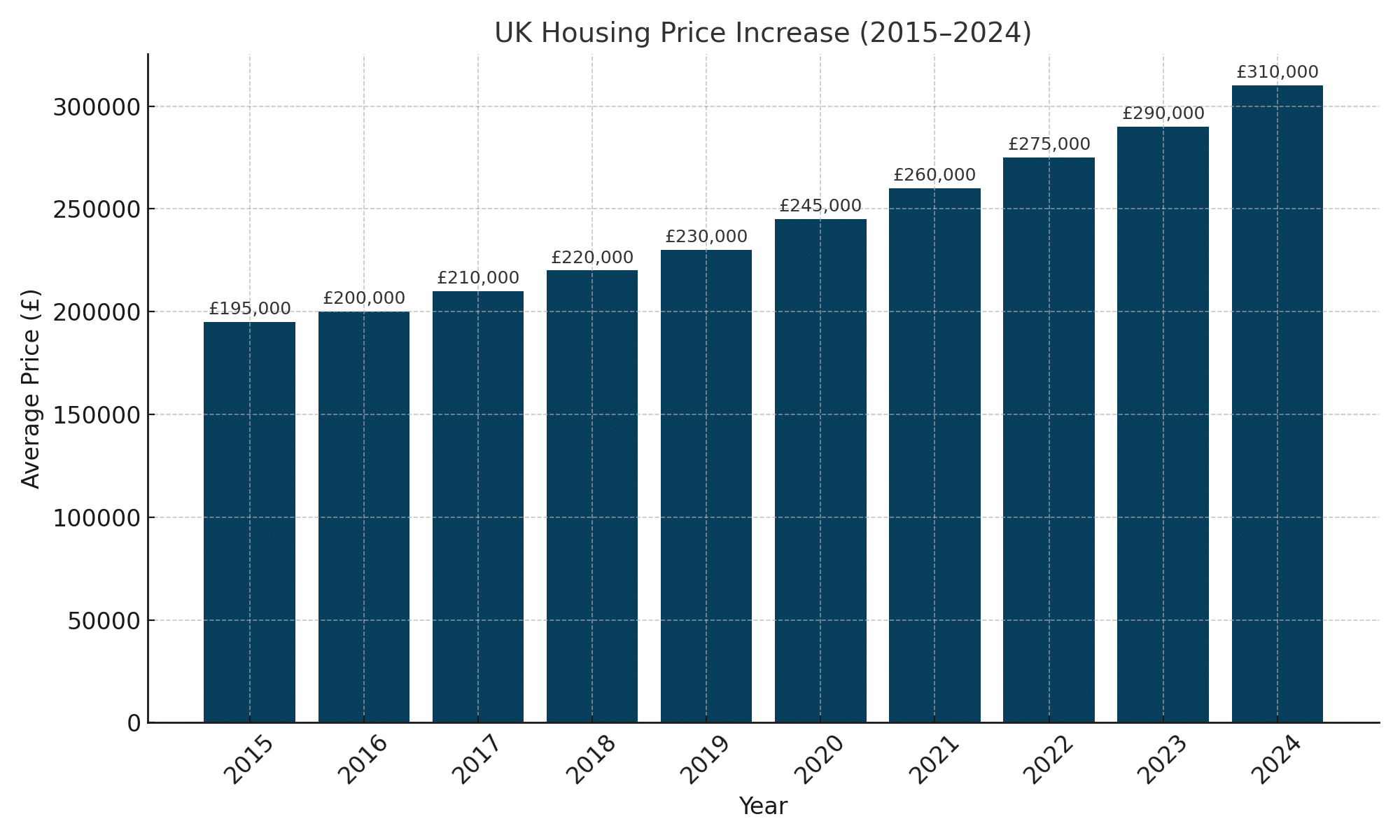

Long-Term Growth Potential

Historically, real estate markets appreciate over time and offer opportunities for both capital growth and reliable rental income.

Why Invest in UK Property Bonds?

Property bonds offer a unique opportunity to earn fixed returns while financing tangible real estate assets in the UK's resilient property market.

Attractive, Predictable Returns

UK property bonds typically offer fixed interest returns that are higher than traditional savings accounts or government bonds. Investors benefit from predictable income, often paid quarterly or annually, making it an appealing choice for those seeking consistent performance. These returns are usually pre-agreed, reducing uncertainty.

Asset-Backed Security

Property bonds are secured against tangible assets, such as land or real estate developments, providing an added layer of protection. In the event of default, the underlying property can be sold to recover investor funds. This asset-backing reduces risk compared to unsecured investment options.

Professional Management

Investments are managed by experienced property developers or financial firms with a proven track record in real estate. Their expertise helps ensure projects are well-planned, compliant, and delivered on time — ultimately safeguarding investor capital. This hands-off approach allows investors to benefit from property without direct involvement.

Long-term Earning Potential

UK property continues to be a high-performing asset class with strong long-term capital appreciation. Property bonds allow investors to tap into this growth through shorter-term, income-generating instruments. Many bonds are structured for 2–5 years, aligning with typical development timelines while offering attractive yields.

Diversification

Adding property bonds to an investment portfolio helps reduce overall risk by spreading exposure across different asset classes. They offer a stable, income-focused alternative to equities or volatile markets. Diversifying into real estate-backed debt can enhance both income and capital preservation.

Economic Stability

The UK property market has shown resilience even during broader economic downturns, supported by consistent demand and housing shortages. This relative stability makes it an attractive environment for fixed-income investments like property bonds. Government support for infrastructure and housing further underpins market strength.

Ready to Invest in Property?

How it works

Download a free investment brochure

Instantly access details on available property developments, potential returns, and risk factors.

Get your insights email

Get tailored information and confirmations delivered straight to your inbox.

Speak to an investment expert

Book a discovery call to explore exclusive opportunities and get expert guidance tailored to your goals.

"As a first-time investor, I was cautious about entering the property market. PropertyInvesting.io made the entire process clear and transparent. The platform is simple to use, and the returns have been exactly as projected. I feel confident and informed every step of the way."

"I’ve invested through other platforms before, but PropertyInvesting.io stands out. The communication is excellent, and the due diligence they conduct is clearly thorough. My Canary Wharf investment is already generating solid returns. I’ve since reinvested in two more opportunities."

"What impressed me most was the level of detail and professionalism. PropertyInvesting.io isn't just about flashy listings – they focus on long-term value. I received regular updates on my investment and saw returns earlier than expected. Highly recommend."